EUR/JPY Worth Evaluation – October 26

There's a tendency that the bullish motion could proceed after the pullback as a result of the coin could shut with a robust bullish candle.

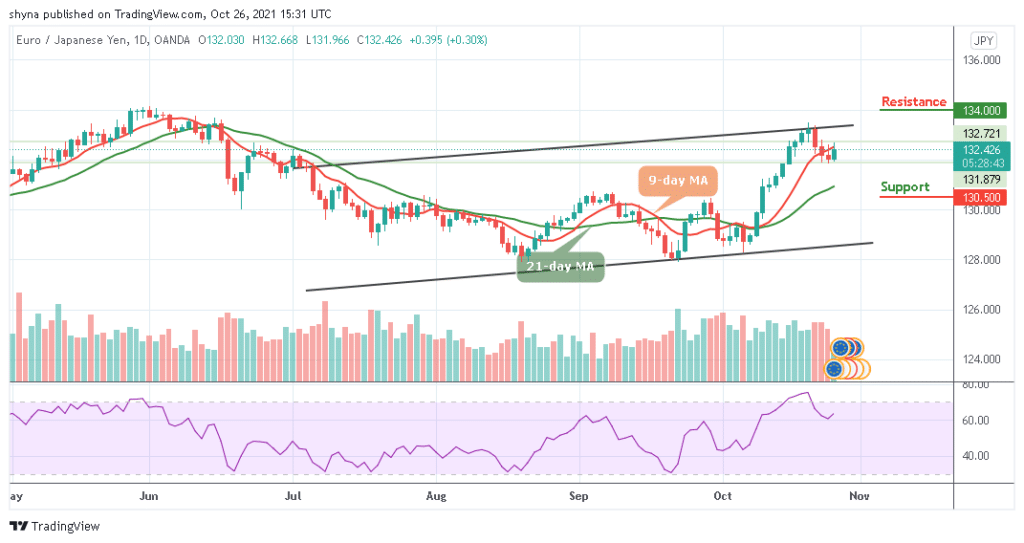

EUR/JPY Lengthy-term Pattern: Bullish (Every day Chart)

Key ranges:

Resistance Ranges: $134.0, $134.5, $135.0

Assist Ranges: $130.5, $130.0, $129.5

On the long-term outlook, EUR/JPY is bullish and it has been following the upward motion for the previous few weeks. Nevertheless, ought to the bulls push up the pair and break above the 9-day transferring common with the bullish candle transferring in the direction of the higher boundary of the channel, then the market value may goal the $133.0 degree. In the meantime, in case the bears proceed to defend the resistance degree of $133, the value could return to the $131.5 degree.

EUR/JPY Worth Evaluation: Would EUR/JPY Climb to the Upside?

EUR/JPY is presently buying and selling at $132.4 after touching the every day excessive of $132.6 and there's a tendency that the bullish motion could play out which can shut the commerce with a robust bullish candle. Nevertheless, the forex pair is attempting to penetrate the higher boundary of the channel and it's prone to commerce above the 9-day transferring common which connotes a rise within the bullish momentum.

In the meantime, the technical indicator Relative Power Index (14) is seen transferring in the direction of the north with the sign line pointing as much as point out an upward motion. Nevertheless, in case the every day bullish candle closes above the higher boundary of the channel, the bullish motion could proceed in the direction of the potential resistance ranges at $134.0, $134.5, and $135.0.

Furthermore, any bearish motion under the 9-day and 21-day transferring averages could expose the forex pair in the direction of the decrease boundary of the channel and there's a excessive risk that the market value could find the important helps at $130.5, $130.0, and $129.5.

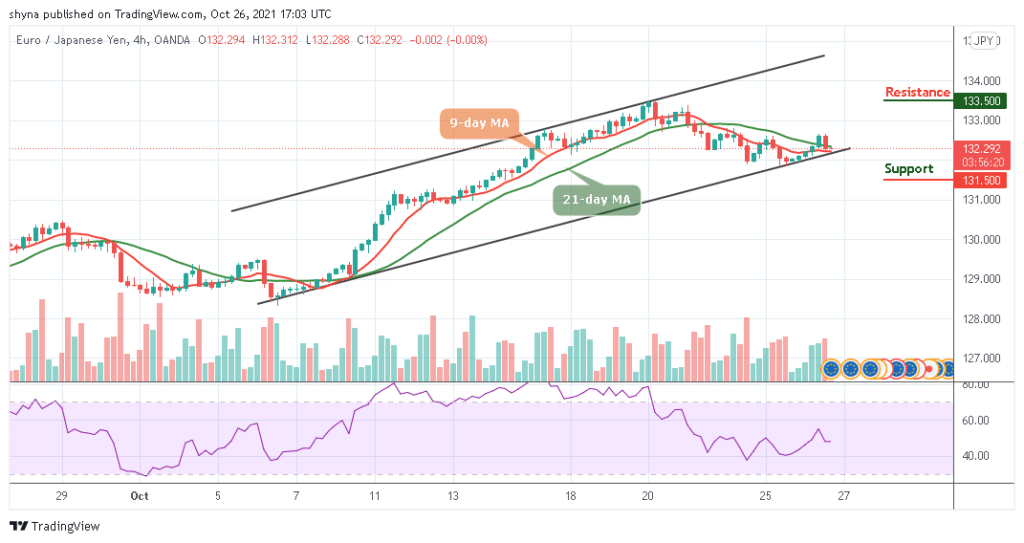

EUR/JPY Medium-term Pattern: Ranging (4H Chart)

EUR/JPY range-bounds on the short-term outlook and there was a bearish breakdown under the 9-day and 21-day transferring averages. The worth is prone to lower additional in the direction of the decrease boundary of the channel whereas the bullish momentum could break up the extent and may very well be interrupted by the bears. Nevertheless, the value could seemingly retest the help degree of $131.5 and under because the technical indicator Relative Power Index (14) could observe the sideways motion whereas the resistance degree may very well be situated at $133.5 and above.