EUR/USD Worth Evaluation – October 5

EUR/USD is at present buying and selling beneath the 9-day and 21-day transferring averages; an additional enhance within the bears’ stress might return the value to the earlier low of $1.156.

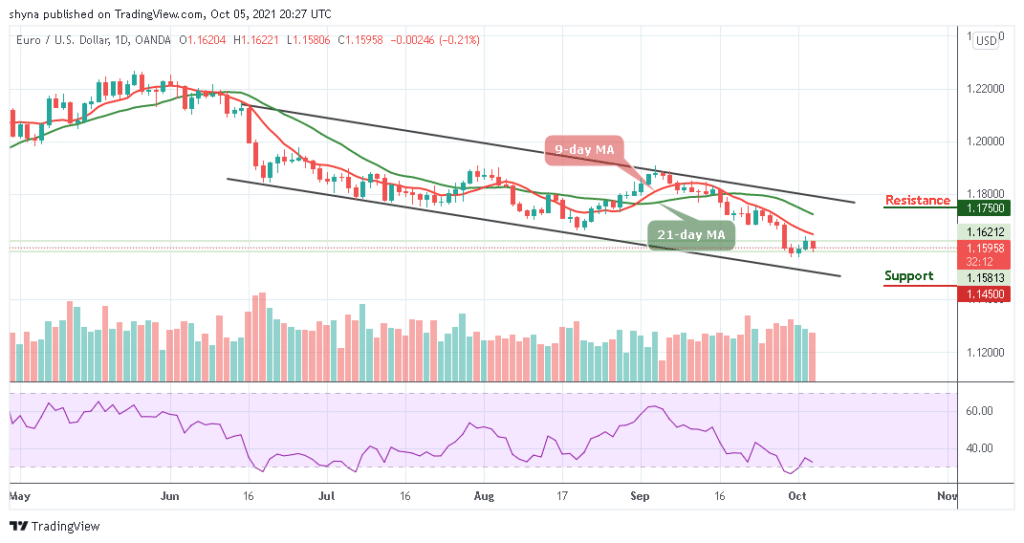

EUR/USD Lengthy-term Pattern: Bearish (Every day Chart)

Key ranges:

Resistance Ranges: $1.175, $1.180, $1.185

Assist Ranges: $1.145, $1.140, $1.135

EUR/USD is bearish on the long-term outlook. The EUR has been weak by way of forex power for some days; that is what offers the EUR/USD alternative to stay beneath the bear for greater than two months. Wanting on the day by day chart, the bulls’ momentum continues to get weak because the bears are progressively taking up the market.

EUR/USD Worth Evaluation: EUR/USD Could Proceed to Observe Bearish Pattern

EUR/USD is buying and selling beneath the 9-day and 21-day transferring averages as the value is transferring in direction of the decrease boundary of the channel, focusing on the $1.160 help. Due to this fact, ought to the bears push down the value beneath this worth degree; the forex pair possible reaches the help ranges of $1.145, $1.140 and $1.135 respectively. Nonetheless, ought to in case the help degree of $1.160 degree holds the forex pair might reverse and face the resistance degree at $1.175, $1.180, and $1.185.

In the meantime, because the red-line of the 9-day transferring common stays beneath the green-line of the 21-day transferring common; the market worth might proceed to observe the bearish development. Nonetheless, that is additionally confirmed by the technical indicator Relative Power Index (14) because the sign line is seen transferring beneath 35-level which signifies that further promote alerts might play out.

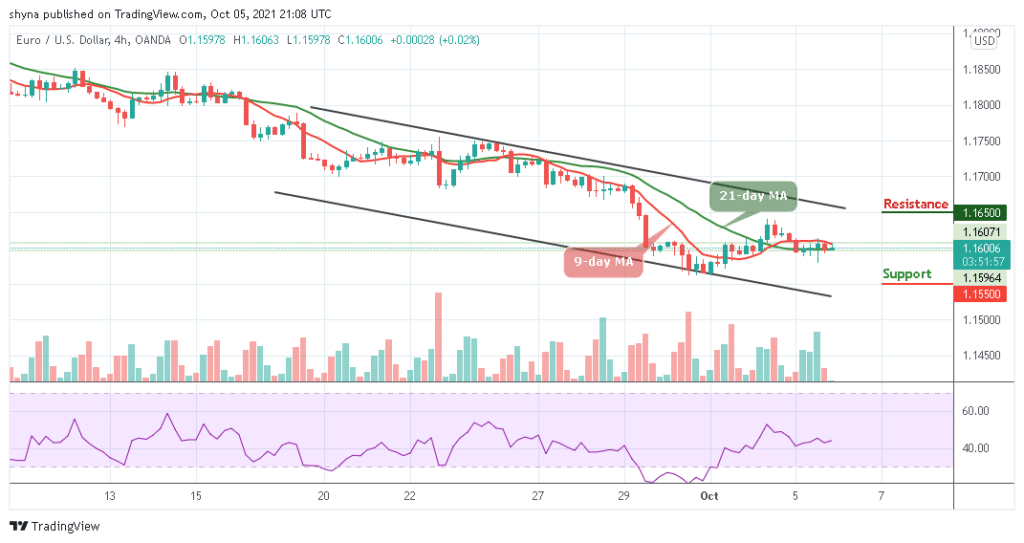

EUR/USD Medium-term Pattern: Bearish (4H Chart)

EUR/USD can also be bearish within the medium-term outlook. The forex pair is rejected on the worth degree of $1.161 and descends to interrupt down the $1.160 help degree. In the meanwhile, EUR/USD is following a sideways motion as the value is prone to lower in direction of the help degree of $1.155 and beneath.

Nonetheless, the 9-day MA is making an attempt to cross beneath the 21-day MA whereas EUR/USD is buying and selling throughout the two transferring averages. Due to this fact, if the forex pair trades beneath the 21-day MA, the market might proceed the downward motion. Furthermore, the technical indicator Relative Power Index (14) is seen transferring round 44-level with the sign line pointing as much as point out a purchase sign. In case the help degree of $1.160 degree holds, the forex pair might reverse and confront the resistance degree at $1.165 and above.