Evaluatie van EUR/JPY waard – 26 oktober

Er is een tendens dat de bullish beweging zou kunnen doorgaan na de pullback als gevolg van het feit dat de munt zou kunnen sluiten met een robuuste bullish kaars.

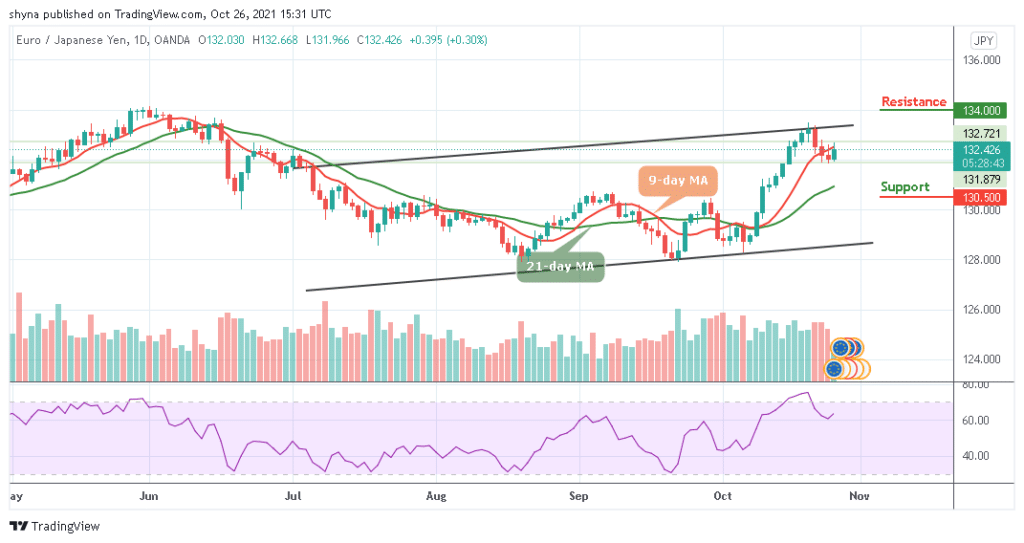

EUR/JPY Langetermijnpatroon: bullish (grafiek voor elke dag)

Belangrijkste bereiken:

Weerstandsbereiken: $ 134.0, $ 134.5, $ 135.0

Hulpbereiken: $ 130.5, $ 130.0, $ 129.5

Wat de langetermijnvooruitzichten betreft, is EUR/JPY bullish en heeft de opwaartse beweging van de afgelopen weken gevolgd. Desalniettemin, als de bulls het paar omhoog zouden duwen en boven de 9-daagse overdrachtsnorm zouden komen, waarbij de bullish kaars in de richting van de hogere grens van het kanaal zou gaan, dan zou de marktwaarde de $ 133.0 graad kunnen bereiken. In de tussentijd, als de beren doorgaan met het verdedigen van de weerstandsgraad van $ 133, zou de waarde kunnen terugkeren naar de $ 131.5-graad.

EUR/JPY Evaluatie waard: Zou EUR/JPY stijgen?

EUR/JPY koopt en verkoopt momenteel voor $ 132.4 nadat ze de dagelijkse overschrijding van $ 132.6 hebben bereikt en er is een tendens dat de bullish beweging zou kunnen uitpakken die de handel kan sluiten met een robuuste bullish kaars. Desalniettemin probeert het forex-paar de hogere grens van het kanaal te penetreren en is het gevoelig voor handel boven de 9-daagse overdrachtsnorm, wat een stijging binnen het bullish momentum impliceert.

Ondertussen ziet men de technische indicator Relative Power Index (14) in de richting van het noorden bewegen, waarbij de tekenlijn evenzeer wijst als een opwaartse beweging aangeeft. Desalniettemin, in het geval dat de dagelijkse bullish kaars boven de hogere grens van het kanaal sluit, zou de bullish beweging kunnen doorgaan in de richting van de potentiële weerstandsbereiken van $ 134.0, $ 134.5 en $ 135.0.

Bovendien zou elke bearish beweging onder de 9-daagse en 21-daagse overdrachtsgemiddelden het forex-paar in de richting van de afnamegrens van het kanaal kunnen blootleggen en is er een buitensporig risico dat de marktwaarde de belangrijke hulp zou kunnen vinden op $ 130.5, $ 130.0, en $ 129.5.

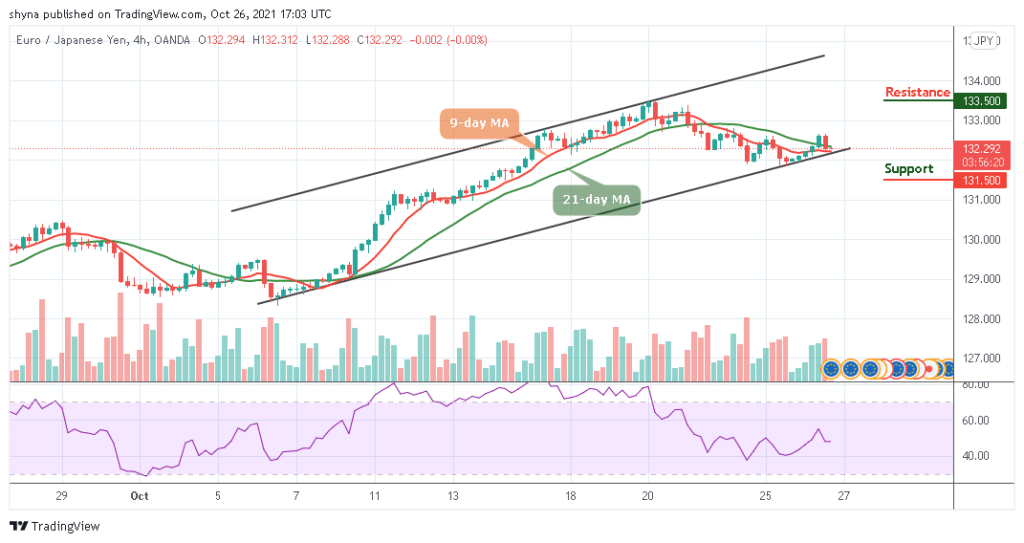

EUR/JPY Patroon op middellange termijn: Variërend (4H-grafiek)

EUR/JPY marge voor de kortetermijnvooruitzichten en er was een bearish uitsplitsing onder de 9-daagse en 21-daagse overdrachtsgemiddelden. De waarde is geneigd om extra te dalen in de richting van de afnamegrens van het kanaal, terwijl het bullish momentum de omvang zou kunnen doorbreken en heel goed kan worden onderbroken door de beren. Desalniettemin zou de waarde de hulpgraad van $ 131.5 en lager schijnbaar opnieuw kunnen testen, omdat de technische indicator Relative Power Index (14) de zijwaartse beweging zou kunnen waarnemen, terwijl de weerstandsgraad zich heel goed op $ 133.5 en hoger zou kunnen bevinden.