Ripple Value Prediction – October 19

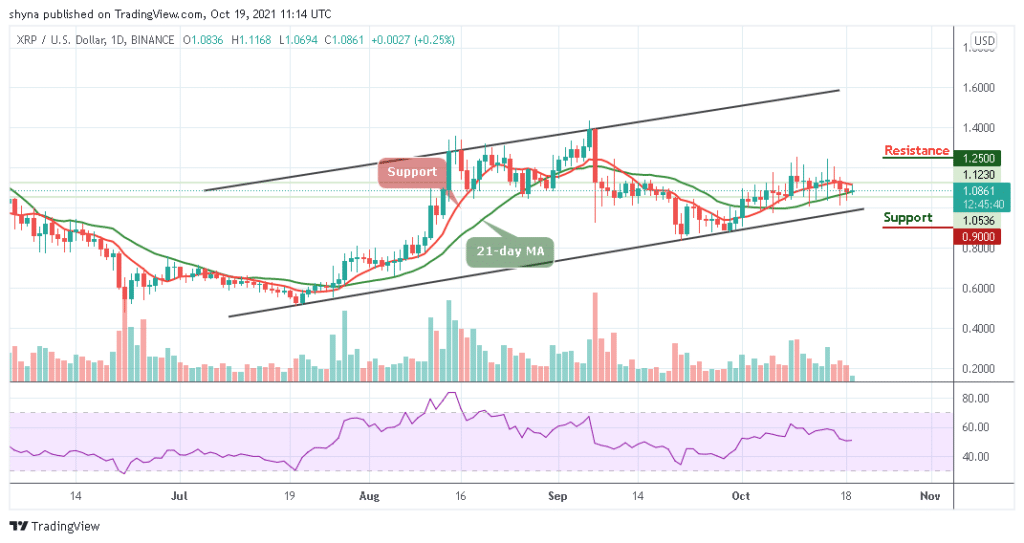

The Ripple value continues to battle with the $1.10 stage after being supported by the 21-day transferring common.

XRP/USD Market

Key Ranges:

Resistance ranges: $1.25, $1.30, $1.35

Help ranges: $0.90, $0.85, $0.80

On the time of writing, XRP/USD is seen buying and selling at $1.08 across the 21-day transferring common aiming to cross above the 9-day transferring common. Nonetheless, the cryptocurrency has been transferring sideways because the coin continues to battle inside the transferring averages. Extra so, within the try to maintain the upward motion, the technical indicator reveals that the bulls are battling to be in command of the market momentum.

Ripple Value Prediction: Ripple (XRP) Could Revisit the Earlier Resistance

Trying on the market motion from above, the closest resistance stage lies at $1.15. Subsequently, any further bullish motion above this stage may make the coin to stay above the 9-day and 21-day transferring averages. If the bulls can break above $1.20, larger resistance ranges are positioned at $1.25, $1.30, and $1.35. In the meantime, if the value decides to cross under the decrease boundary of the channel, the closest assist to succeed in is positioned at $0.95 stage. Beneath this, additional helps may very well be positioned at $0.90, $0.85, and $0.80.

Nonetheless, the technical indicator Relative Energy Index (14) is prone to make a fast bullish cross to the north because the sign line strikes above 50-level. Extra so, the Ripple value might keep inside the constructive aspect in as a lot because the 9-day transferring common stays above the 21-day transferring common.

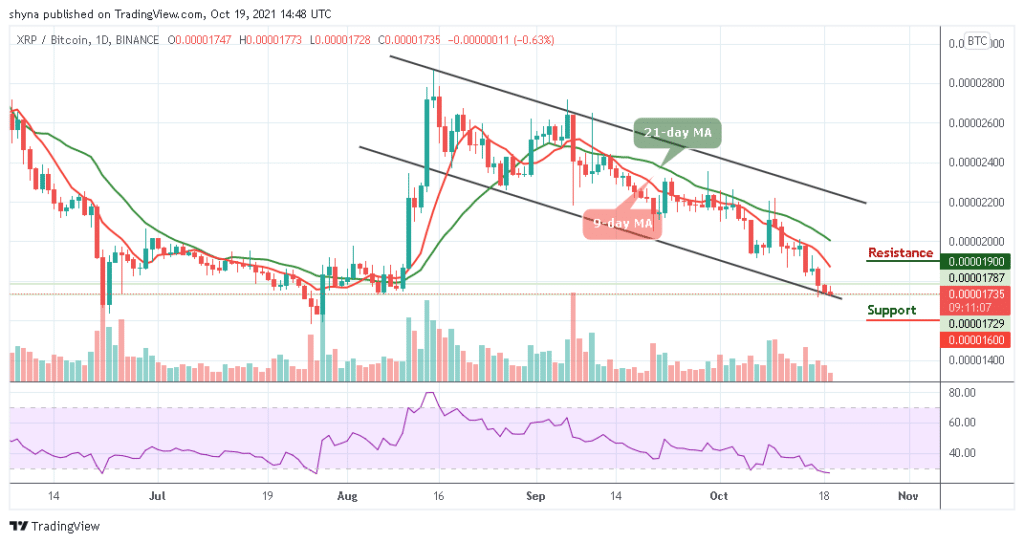

In opposition to Bitcoin, it may be seen that XRP has been falling under the 9-day and 21-day transferring averages because it presently trades at 1735 SAT. it from above, the closest resistance stage may very well be discovered round 1800 SAT. Nonetheless, if the patrons push the Ripple (XRP) above this stage, the upper resistance stage can be positioned at 1900 SAT and above.

Nonetheless, the market value might doubtless cross under the decrease boundary of the channel with a purpose to give extra bearish indicators. If the downtrend motion continues, it might probably result in the assist stage of 1600 SAT and under because the technical indicator Relative Energy Index (14) stays inside the oversold area.