USD/CHF Value Evaluation – October 12

The bulls are at the moment pushing the forex pair upward as USD/CHF exposes to the upside with sturdy momentum and should surpass the resistance stage of $0.930.

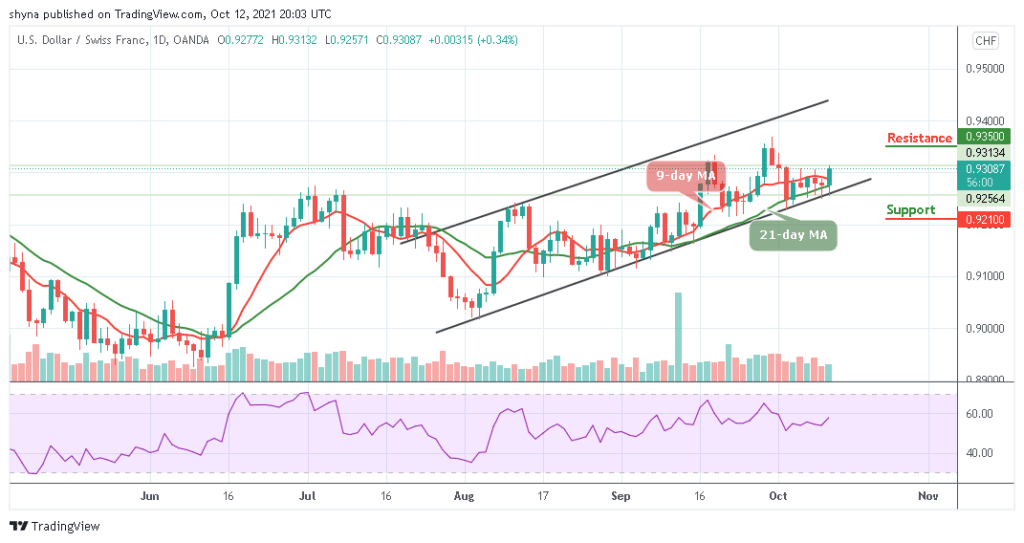

USD/CHF Lengthy-term Development: Bullish (Every day Chart)

Key ranges:

Resistance Ranges: $0.935, $0.940, $0.945

Assist Ranges: $0.921, $0.916, $0.911

USD/CHF is bullish on the long-term outlook. Yesterday, the market touched the help stage of $0.925.The Bulls’ strain elevated final week and broke up the availability stage of $0.913. Right this moment, after the pullback, a powerful bullish momentum gathers and that is confirmed with the formation of the day by day bullish candle. The worth is heading in the direction of the resistance stage of $0.931.

USD/CHF Value Evaluation: USD/CHF Bulls Could Achieve Extra Strain

The forex pair is shifting above the 9-day and 21-day shifting averages as a logo of a rise within the bulls’ momentum. After touching the day by day low of $0.925, the pair crosses above the shifting averages to hit the day by day excessive at $0.931. In the meantime, an additional enhance within the bulls’ strain is extremely doable and the resistance stage of $0.935, $0.940, and $0.945 could also be visited.

Quite the opposite, any interruption by the bears could also be a pullback, which is probably not seen within the trending market for the time being. Nonetheless, the technical indicator Relative Energy Index (14) is more likely to cross above 60-level with the sign line pointing to the north suggesting a bullish motion. In different phrases, the helps stage of $0.921, $0.916, and $0.911 might seemingly come to focus if the forex pair slumps under the decrease boundary of the channel.

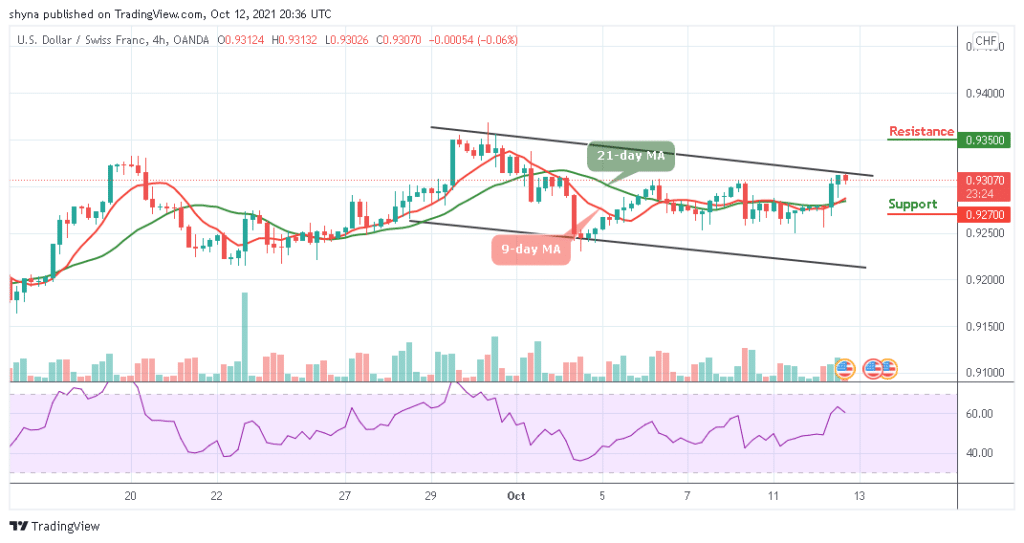

USD/CHF Medium-term Development: Ranging (4H Chart)

USD/CHF is ranging on the medium-term outlook because the forex pair is but to interrupt above the higher boundary of the channel. Nonetheless, the ranging motion might proceed above the 9-day and 21-day shifting averages because the technical indicator confirms. Extra so, radical elementary occasions could also be essential for a bullish breakout to play out.

Furthermore, the forex pair is at the moment hovering at $0.930 and the Relative Energy Index (14) is more likely to cross under 60-level with the sign line pointing down to point a promote sign. Nonetheless, the help stage stays at $0.927 and under whereas the resistance stage is situated at $0.935 and above.